You'd hope there's no hitch connecting up the Zoom meetings on this next investor roadshow.

Street Talk understands ASX-aspirant and telecommunications services provider Aussie Broadband has started booking in meetings with fund managers ahead of a slated $150 million listing next month.

Investors told this column chief executive Phillip Britt would lead a roadshow starting later this week, giving management the chance to pitch their credentials to fundies and walk them through the business' numbers, outlook and growth plan.

As revealed by this column in September last year, Aussie Broadband had tapped Shaw and Partners as sole manager on a potential sharemarket float after the stockbroker oversaw a $25 million pre-IPO fundraising round 12 months ago, which attracted investment from the likes of Perennial Value and Thorney Group.

Sources said Aussie Broadband was hoping to snare up to $40 million in its IPO, which if successful would see the company hit the ASX-boards late August/early September, subject to market conditions.

It is understood Shaws and Aussie Broadband will run fund managers through the business' organic growth, with subscriber numbers said to have doubled in the last 12 months.

Sources said the company would also point to its cheap client acquisition costs. It is understood it costs Aussie Broadband $80 to organically acquire a new customer versus $200 to poach a customer off a rival telecommunications outfit.

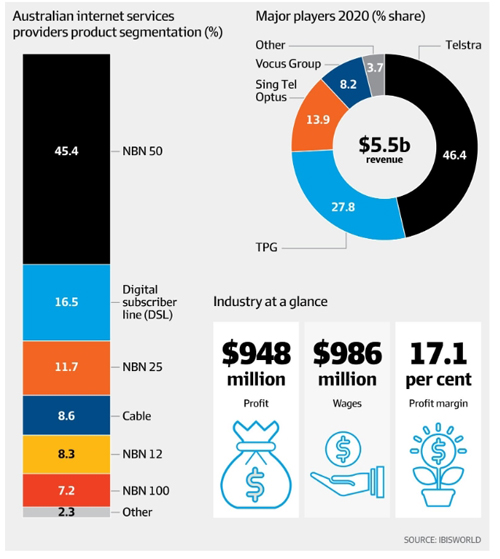

Aussie Broadband is the fifth largest national provider of NBN services in Australia and has 254,000 customers, compared to 20,000 four years ago.

The company notched up $101 million in sales revenue for the 12 months to June 30, 2019, according to documents lodged with the corporate regulator. In the 12 months prior, Aussie Broadband had posted revenues of $51 million.

Aussie Broadband has also re-jigged its leadership in advance of the mooted listing, boosting its board's financial management experience with three new members, including Pitcher Partners founding partner Adrian Fitzpatrick joining as chairman.

The company has also brought in former Woolworths chief legal officer and company secretary Richard Dammery and ASX listed Big River Industries board member Vicky Papachristos as non-executive directors.

Article source: AFR, 26 July 2020